Will Health Care Take the Baton? 🌤️ The Morning Print

Good morning!

Rotation into value and defensive groups remains intact.

Materials, Energy, Consumer Staples, and Utilities are all trading near record highs.

Health Care now looks well-positioned to be the next defensive sector to break higher.

Here's the setup.

The Health Care ETF ($XLV) is coiling just beneath all-time highs with volatility extremely compressed.

Last November, $XLV registered its strongest three-day relative gain versus the S&P 500 since 2022, and prior to that, 1990.

Since then, the sector has spent the past several months digesting those gains.

That type of pause following historic momentum typically resolves in the direction of the underlying trend.

We think another big move is on the way for Health Care.

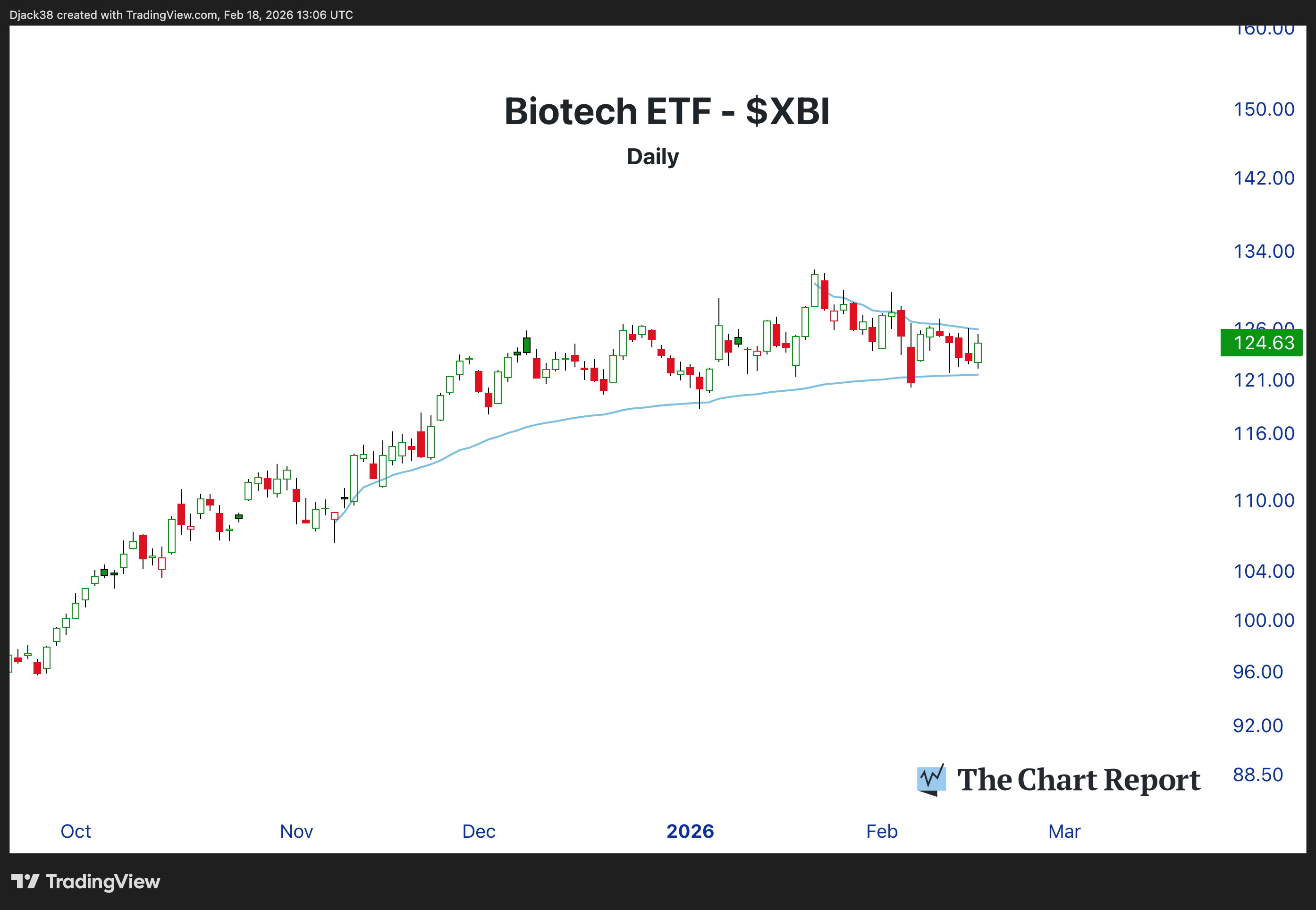

If you want extra juice in the sector, take a look at the Biotech ETF ($XBI).

Biotech has formed a tight VWAP pinch between the November lows and January highs.

This is a classic volatility squeeze, as buyers and sellers battle it out in a tightening range.

If Health Care breaks higher, Biotech likely moves with it.

The setup is there — now we wait for price to confirm.

The Morning Print is brought to you by The Chart Report.

If you would like to share a chart or just say hi, shoot us an email at info@thechartreport.com.