Is Growth Ready to Lead Again? 📈 The Chart Report

Chart of the Day

🏆 Today's Chart of the Day was shared by Scott Brown.

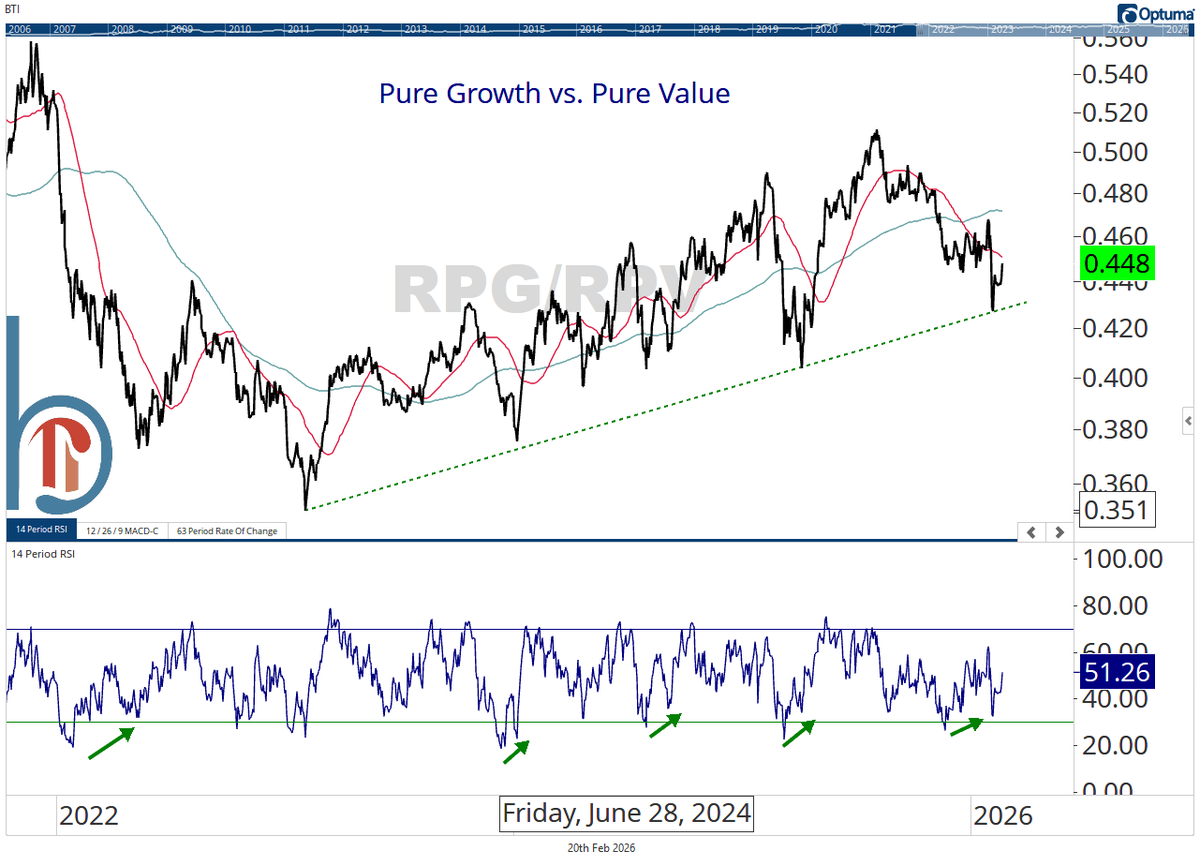

Pure Growth versus Value (RPG/RPV) is holding trend-line support dating back to its January 2023 bear market low.

RSI has carved out a bullish divergence, and prior instances have marked meaningful bottoms in this ratio.

If growth is going to reassert its dominance, this is a solid first step, but we must see follow-through.

The Takeaway: The pairing of trend-line support and a bullish RSI divergence gives growth an opportunity to reclaim leadership relative to value.

More Great Charts

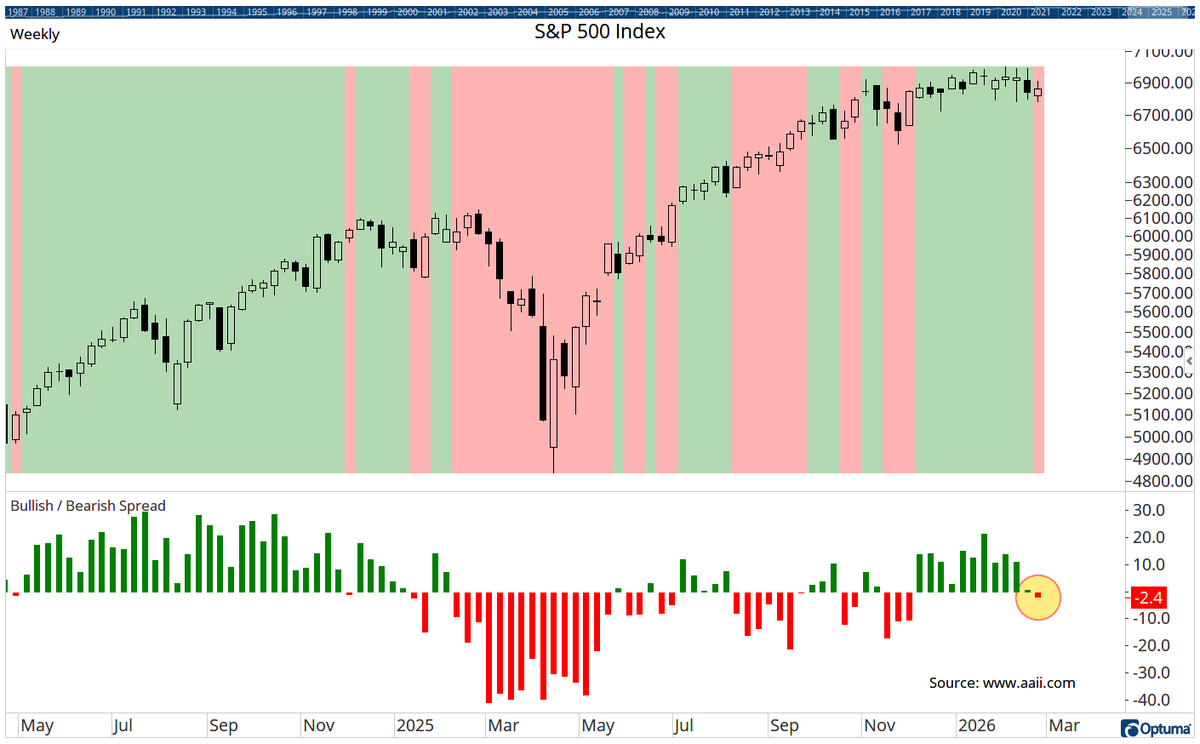

This week’s AAII Sentiment Survey shows bears outnumbering bulls for the first time since Thanksgiving.

See Optuma's full tweet.

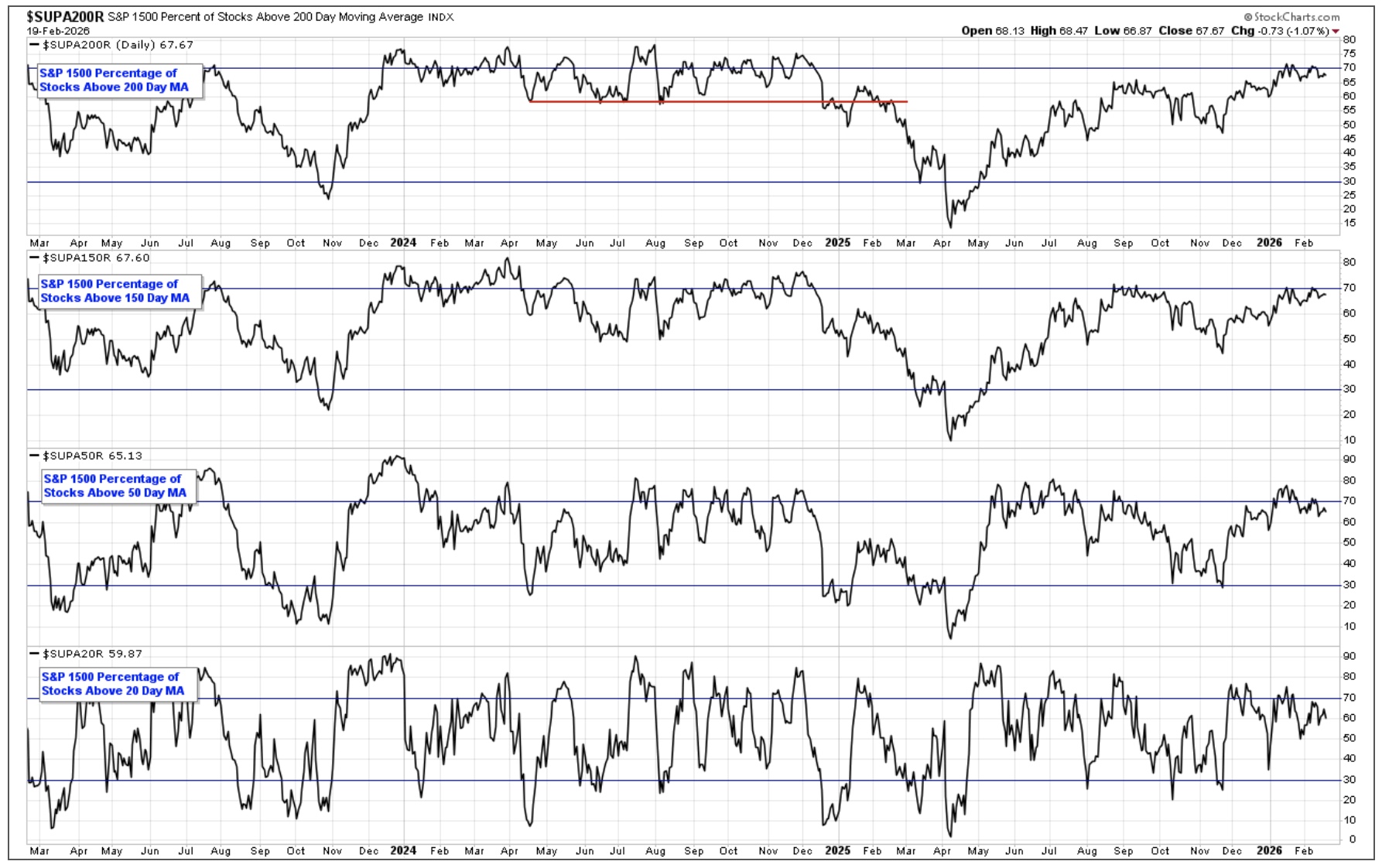

Breadth remains positive.

Roughly 65% of the S&P Composite 1500 is trading above key moving averages.

Get the complete breakdown from Stage Analysis.

While YTD sector leadership leans defensive, the Nasdaq remains resilient and longterm breadth has yet to flash a bearish signal.

Arthur Hill shares his perspective.

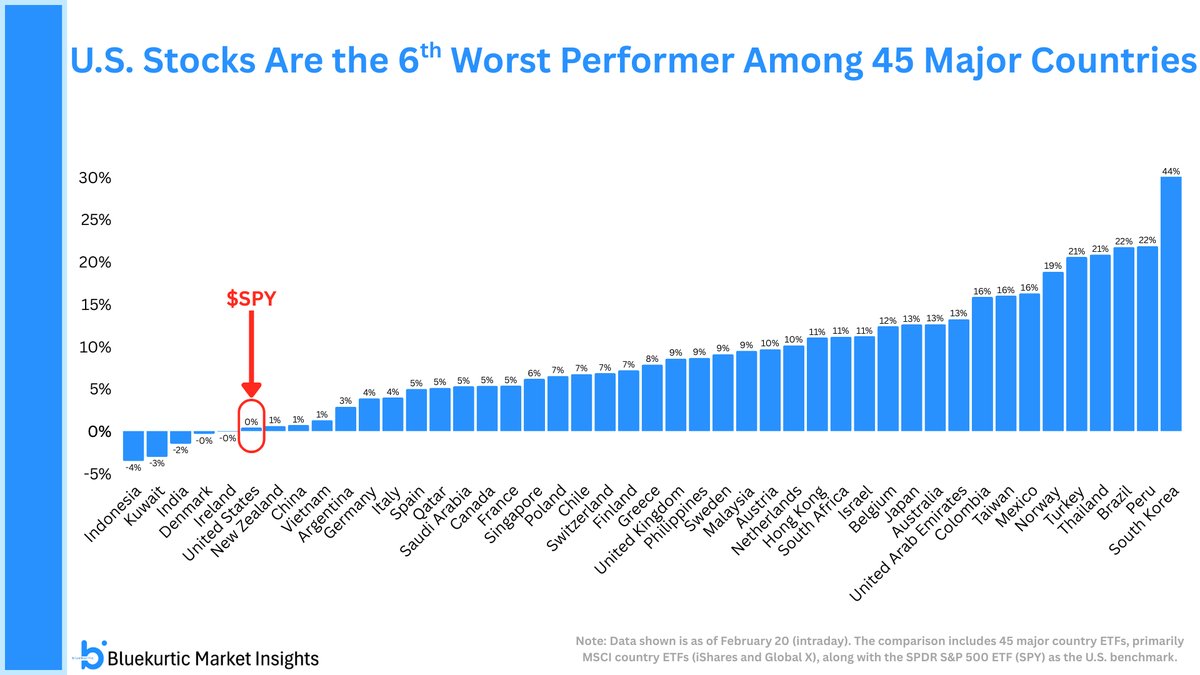

Year-to-date, U.S. equities rank just 6th worst out of 45 major countries.

Check out the post from Bluekurtic Market Insights.

The iShares Latin America 40 ETF finished the week at its highest level since 2018.

Get access to Andy Featherston's most recent article.

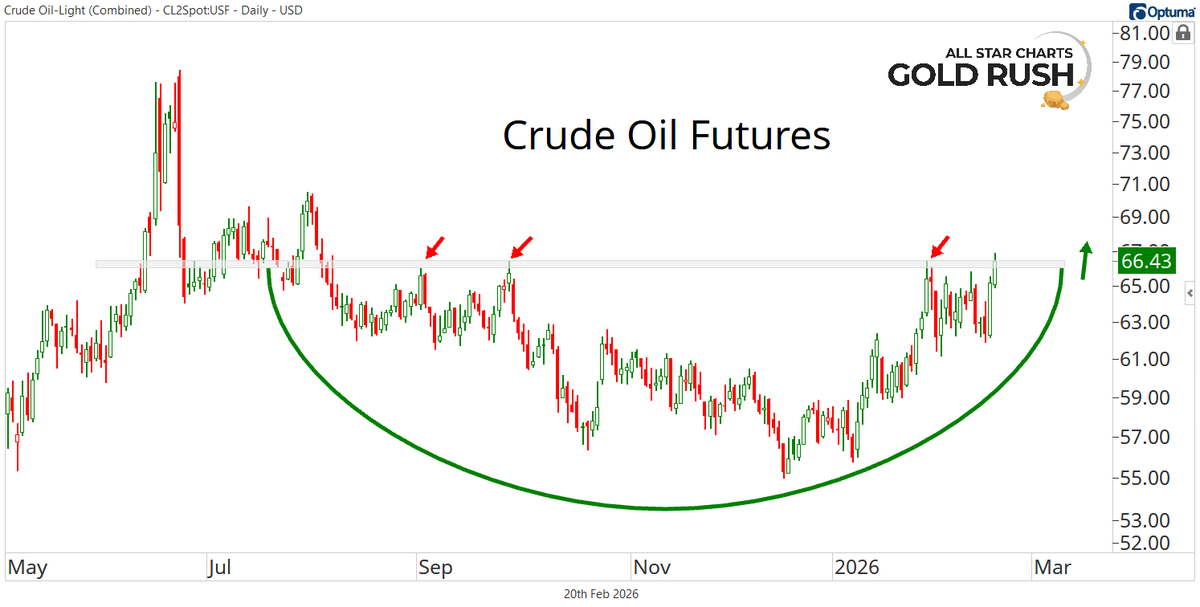

Crude Oil is attempting to put the finishing touches on this multi-month base.

View Sam Gatlin's complete tweet.

Treasury bonds have historically struggled under Quantitative Easing regimes.

Tom McClellan walks through the evidence in his latest note.

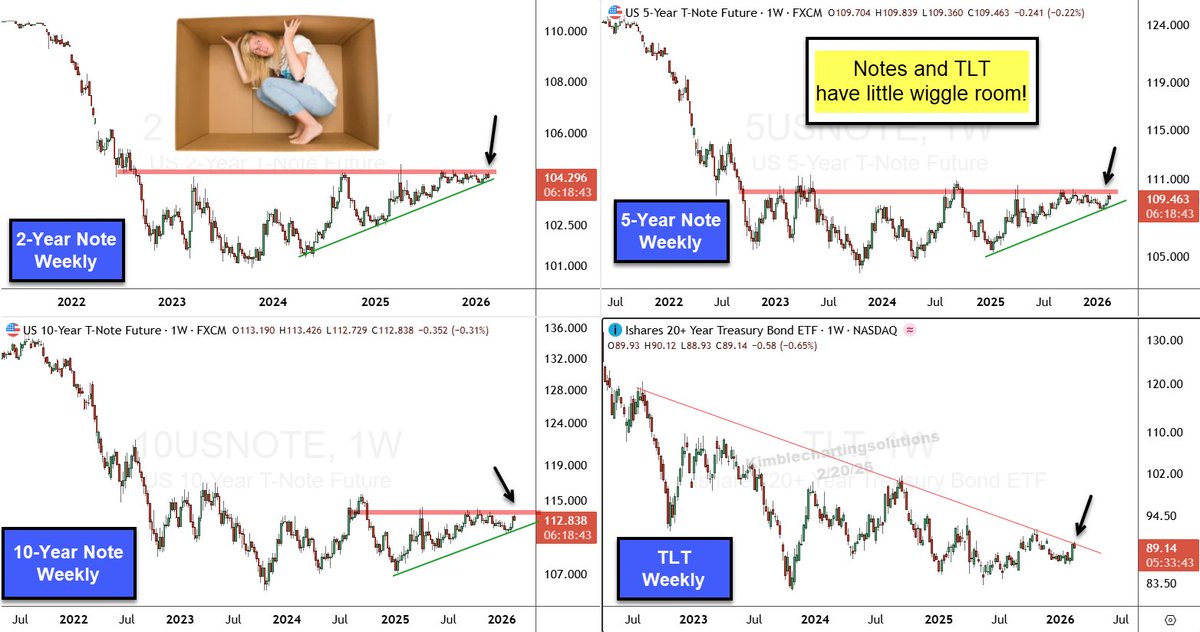

Volatility within fixed income is extremely compressed.

Take a look at Chris Kimble’s full post.

The Chart Report curates best-in-class technical analysis from across the web.

If you’d like to share a chart or just say hello, email us at info@thechartreport.com